Market Growth Rate This is the X- axis or the horizontal line.

The market share is measured relative to a brands largest competitor and a higher market share means higher cash return. This is in relation to the experience curve.Īlso, another reason for the selection is that this indicator carries more information than just cash flows, but also profits in relation to a brands competition and can be a good forecast tool for expectations. The primary reason for use of this indicator in the matrix is the assumption that large productions of goods means a company will benefit from the economies of scale which means higher profitability.

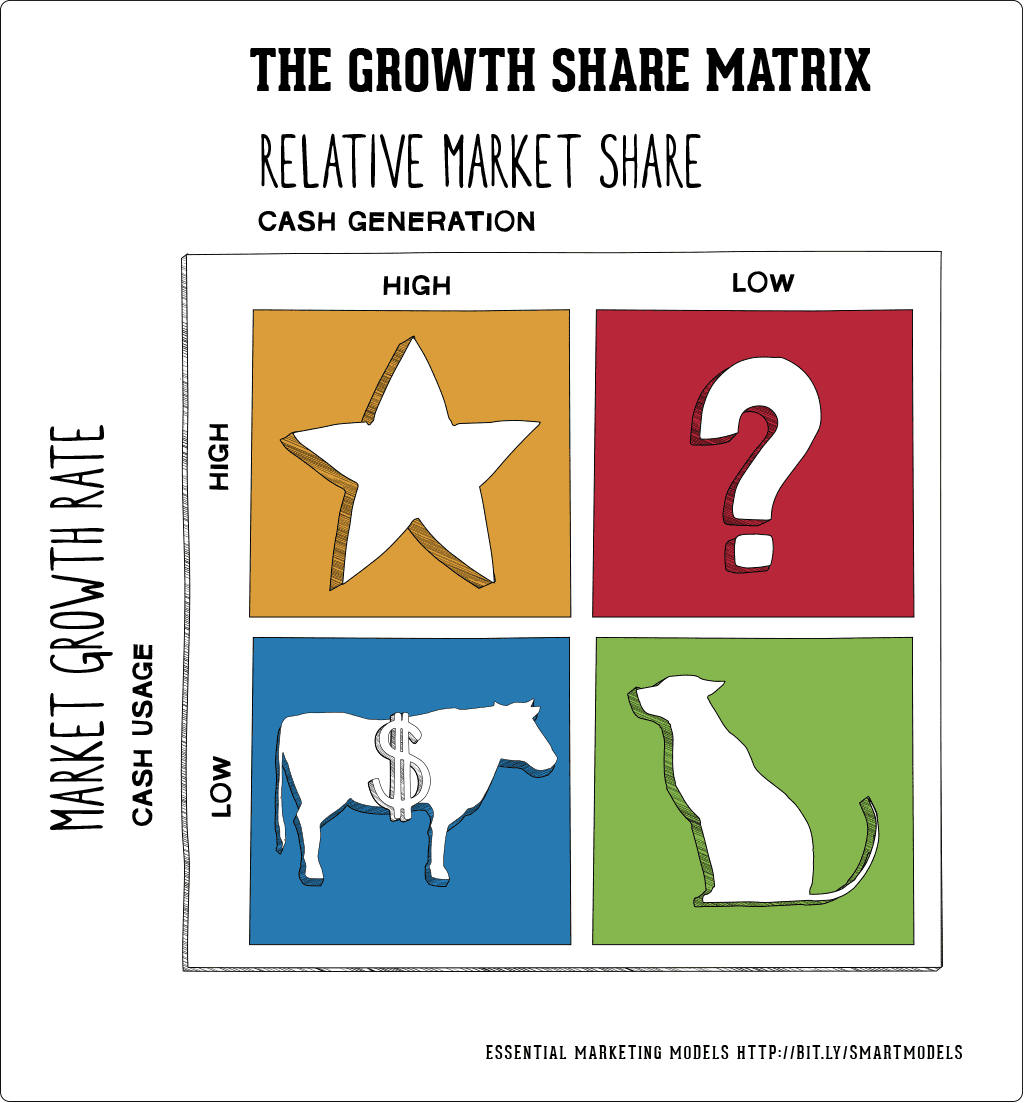

High growth products require cash inputs to grow. The portfolio composition is a function of the balance between cash flows. Anderson is often quoted as below in defense of the growth matrix as an effective tool To be successful, a company should have a portfolio of products with different growth rates and different market shares. The model assumes that one of the main indicators for cash generation is relative market share, whereas the indicator for cash usage is the projected market growth rate. Below is a visual representation of the matrix. Note, the market share is a company-specific metric while, the market growth rate is an industry metric. The y-axis of the graph/matrix represents rate of market growth while the x-axis represents a products overall market share. The market growth rate is this years industry sales minus the past years industry sales. Market share compares the SBUs sales in the current year versus those of competitors. The matrix is a 2 x 2 quadrant a column heading Market Share and row heading Market Growth Rate. Back to: STRATEGY & PLANNING Structure of the BCG Matrix This tool works for firms with diversified product lines and involves plotting ones products on a four square matrix. The BCG Growth Share Matrix is simple strategic planning tools that can aid companies in reviewing their brand competitive positions as well as assist in making key decisions such as whether to develop a certain business unit, sell the same, discontinue or increase investment. These sub-businesses are known as strategic business units. The purpose of the matrix is to allow a corporation that has multiple business units or is the parent company holding multiple businesses to categorize and examine those businesses based upon their market share and growth rates.

The BCG matrix, also known as the growth-share matrix, was created by the Boston Consulting Group, a prestigious business consulting firm.

0 kommentar(er)

0 kommentar(er)